Medical billing and coding often come with challenges. Here, we discuss how you can start avoiding medical upcoding and downcoding.

Navigating the complex world of medical coding and billing is a crucial part of running a successful practice. However, it often comes with its own set of challenges. While upcoding and downcoding are on opposite sides of the same medical billing and coding coin, they are two of the most significant challenges that impact healthcare providers and their patients. So, understanding and avoiding upcoding and downcoding is essential to making sure you receive proper reimbursement for the services rendered.

Understanding Upcoding and Downcoding

Upcoding happens when providers bill for more expensive procedures than what they performed on their patients. This creates problems because the codes used don't accurately reflect the care given. Eventually, this can lead to overcharges or even fraudulent behavior in extreme cases. Healthcare practices that upcode can be in violation of several federal and state laws that will lead to severe legal and financial consequences. One of the glaring risks of upcoding is your healthcare practice being under an audit, and the audit reveals your practice has received more reimbursements than it was supposed to.

On the flip side of the medical billing coin, downcoding occurs when providers submit claims using lower-level codes than necessary. This may occur intentionally to reduce costs or unintentionally due to a lack of knowledge about proper coding practices. Like upcoding, downcoding also leaves healthcare practices more vulnerable to an audit, which no healthcare practice ever wants to experience.

Downcoding can also cost a practice thousands of dollars a year in lost revenue! When services are improperly coded with lower-level codes, the practice may receive lower reimbursement rates—resulting in lost revenue.

The NCCI (National Correct Coding Initiative) addresses downcoding by stating:

Physicians must avoid downcoding. If a HCPCS/CPT code exists that describes the services performed, the physician must report this code rather than report a less comprehensive code with other codes describing the services not included in the less comprehensive code.

How Can Practices Start Avoiding Medical Upcoding and Downcoding

Avoiding upcoding and downcoding are not just important issues for compliance but for your practice's bottom line. To prevent these costly errors from happening, it's important to stay current with all relevant regulations and familiarize yourself with industry best practices regarding medical billing and coding processes—as well as any changes that could affect how you bill patients today or in the future. Also, reviewing documentation prior to filing insurance claims can help ensure accuracy, while double-checking claim statuses frequently will keep everything running smoothly once submitted.

So, how can your practice reduce the chances of someone accusing it of taking part in fraudulent billing practices?

Avoiding upcoding and downcoding are not just important issues for compliance but for your practice's bottom line. To prevent these costly errors from happening, it's important to stay current with all relevant regulations and familiarize yourself with industry best practices regarding medical billing and coding processes—as well as any changes that could affect how you bill patients today or in the future. Also, reviewing documentation prior to filing insurance claims can help ensure accuracy, while double-checking claim statuses frequently will keep everything running smoothly once submitted.

So, how can your practice reduce the chances of someone accusing it of taking part in fraudulent billing practices?

Avoiding upcoding and downcoding are not just important issues for compliance but for your practice's bottom line. To prevent these costly errors from happening, it's important to stay current with all relevant regulations and familiarize yourself with industry best practices regarding medical billing and coding processes—as well as any changes that could affect how you bill patients today or in the future. Also, reviewing documentation prior to filing insurance claims can help ensure accuracy, while double-checking claim statuses frequently will keep everything running smoothly once submitted.

So, how can your practice reduce the chances of someone accusing it of taking part in fraudulent billing practices?

Step 1: Ensure Proper Documentation and Coding Education

Accurate and detailed documentation is essential in order to start avoiding medical upcoding and downcoding. It ensures that healthcare providers receive reimbursement for the services they provide. Without accurate documentation, coding errors are likely to be made, resulting in incorrect payments or even denials from payers. Having comprehensive records that demonstrate patient care should be a top priority for practices when attempting to maximize coding efficiency.

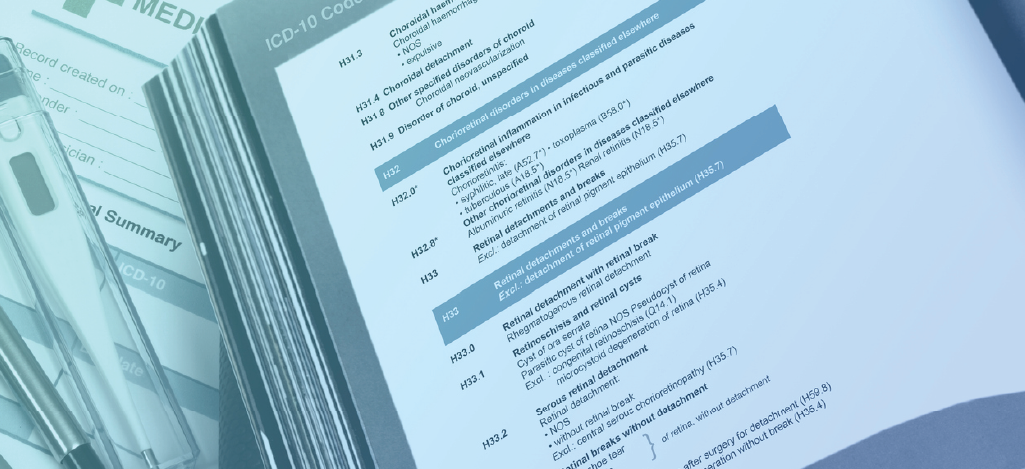

Providing education and training on proper coding practices maximizes coding accuracy and efficiency within a health system or practice setting. Healthcare personnel must understand the use of various codes. This way, they can apply these codes correctly throughout their medical documentation. Their understanding of the codes also helps the entire practice stay up-to-date with ICD-10 code changes. Education and training also ensure medical personnel is up-to-date with any new policies regarding medical billing procedures set by insurance companies or other parties involved in the payment process.

In addition to providing educational resources about correct coding practices, implementing initiatives designed just for improving the accuracy of medical billing can help ensure success when it is time to submit claims for reimbursement purposes—ultimately leading to greater revenue cycle performance.

By having tailored strategies such as monitoring chart completion rates, assessing current forms/documentation templates, carrying out audits of completed charts before submission, etc., your practice will be in the best position to optimize both its data integrity and financial gain from accurate claims submissions.

Step 2: Implement Robust Compliance Programs

Healthcare practices should create an official compliance committee that will bear the responsibility of overseeing all aspects of medical coding, billing, and reimbursement-related practices. A designated compliance officer should provide oversight to ensure these activities are conducted correctly and comply with all applicable regulations.

Establishing written policies regarding proper coding techniques and billing procedures is also important. This helps standardize processes across the practice, as well as reduce potential risks connected to non-compliance or improper use of codes or documentation standards. These policies should also outline specific steps needed when submitting claims for services rendered. This way, staff members who handle this process from day to day can easily follow them.

Regular internal audits can help assess if any changes need to take place in order to stay compliant with standards set out by governing bodies such as Medicare and Medicaid. These audits will also ensure there are no issues within current operations that would result in heightened financial burdens due to not being paid properly for services provided.

Monitoring ongoing billing and coding activities is not just important but necessary in avoiding medical upcoding and downcoding. It puts your practice in a position to identify any inaccuracies quickly before they become too costly to fix.

Step 3: Stay Updated with Coding Guidelines and Regulations

Staying compliant with coding regulations and avoiding upcoding and downcoding isn't something you can just skim over. In fact, it's essential for the success of your practice. All practices must make sure they're aware of current codes such as CPT, HCPCS, and ICD-10 so that all billing is accurate from the start. It is also important to keep an eye out for any updates from regulatory bodies such as CMS or AMA. There may be changes in how claims should be submitted that could affect your bottom line if they go unnoticed.

Continuous professional development doesn't have to stop when medical school does. Making sure everyone involved is knowledgeable about medical billing and coding standards means fewer oversights or variations that could cause a current/former patient, current/former employee, or anyone else familiar with your practice to accuse it of fraudulent billing practices down the line.

Step 4: Implement Checks and Balances in the Billing Process

Checks and balances in the billing process are another important pieces in the complex puzzle of avoiding upcoding and downcoding. This piece of the puzzle helps maintain the integrity and accuracy of financial transactions in your practice. Implementing internal controls to detect and prevent fraudulent billing practices is a critical step. This involves establishing policies and procedures that clearly outline your practice's billing process and define the roles and responsibilities of your medical staff.

Segregation of duties will ensure that each person or team will handle separate aspects of billing. Implementing authorization procedures will also ensure that invoices and billing records are approved by authorized members of the medical staff. Utilizing technology solutions can significantly enhance the effectiveness of the billing process. For example, billing software can automate and streamline invoicing, payment processing, and record-keeping. This, in turn, reduces the chances of human errors and provides an audit trail.

Automated auditing tools can also help analyze billing data and identify irregularities. These tools can flag duplicated invoices, payment patterns that are out of the ordinary, or changes that stray away from standard billing practices. Performing regular reviews and reconciliations of billing records ensures your practice maintains its accuracy and integrity. Regular reviews involve the cross-checking of invoices with supporting documentation—this verifies their legitimacy and accuracy. Reconciliations should be conducted between billing records and financial records to identify any discrepancies.

Step 5: Conduct External Audits and Independent Reviews

As we mentioned, external audits and independent reviews ensure your medical practice never has to worry about transparency or compliance. Partnering with external auditors or consultants who specialize in coding and billing practices is the first step. You should choose experts based on their expertise, knowledge of the medical industry, and track record. You should also clearly define the scope of your audit before the process begins, providing an overview of what to review (i.e. billing code accuracy, billing compliance, medical documentation practices, RCM).

Not only should you use external audits, but you should also seek third-party reviews from industry experts or organizations with a proven reputation that can provide an objective assessment of your practice's medical coding and billing practices. These reviews validate compliance with medical industry regulations and best practices. The reviewers will also highlight any areas not in compliance with the standards and offer recommendations for what to improve.

Overall, the reviews will place a brighter spotlight on hidden opportunities for billing and coding process enhancement. Healthcare practices that seek the help and knowledge of third-party reviews should carefully review the audit findings and review reports.

Wrapping Up

By taking the steps we have shared, your practice can start avoiding the effect that comes with upcoding and downcoding. Thorough documentation and coding training, comprehensive policies and procedures, regular internal audits, checks and balances in the billing process, and external audits and independent reviews all play long-lasting roles in promoting transparency, compliance, and accuracy. Prioritize ethical billing practices and understand the consequences of fraudulent billing (whether intentionally or unintentionally).With BillFlash RCM Services, your practice can significantly enhance its financial performance, reputation, and overall quality of patient care with our team of expert medical billers and coders. Unlock the transformative power of seamless medical billing and payments by scheduling your demo now!